NJ Real Estate Market Overview

Although national foreclosures are at an all-time low, NJ foreclosures are the highest they’ve been in eleven years. Just last year, the total number of bank-owned homes jumped from 1,448 to 2,308. Part of the reason for this is that the state foreclosure process is a years-long process; repossessed properties from the crash are just now reaching the market. With the reduced supply of Class A, move-in ready homes, the influx of distressed properties is attractive to investors with all levels of experience.

Jersey buyers are looking for locations that are close to mass-transit with good schools; right now, townhouses, condos, and rentals are more in demand than single family homes. For commercial investors, industrial supply is more in demand than retail or office space. Jersey is a major transportation state, with efficient and centrally located routes for trucks, trains, and ships. As a result, the market for converted warehouses along the NJ Turnpike and major highways is red hot.

| City | Overall Grade | Public Schools | Housing |

| Princeton Junction | A+ | A+ | A- |

| Lawrenceville | A+ | A | A- |

| Beckett | A | A- | A- |

| Upper Montclair | A+ | A+ | A- |

| Heathcote | A+ | A+ | B+ |

The 2018 Tax Plan will have repercussions for real estate owners across the country – and for investors as well. Not only is there now a $10,000 cap on state and local tax deductions, but the cap on mortgage interest deductions dropped from $1,000,000 to $725,000. This could mean that potential owners will look for more affordable properties to avoid taking out a mortgage of about $725,000, or they may choose to rent rather than to buy.

Although the tax plan increases taxes for homeowners, it decreases taxes for businesses and entities. Real estate investors may be able to take advantage of this discrepancy by holding properties as rentals, offering solutions for homeowners who want to avoid higher, non-deductible mortgages. However, some experts warn that the NJ market may change drastically in the coming year, due to both the tax changes and the tension between the state legislators and the new administration.

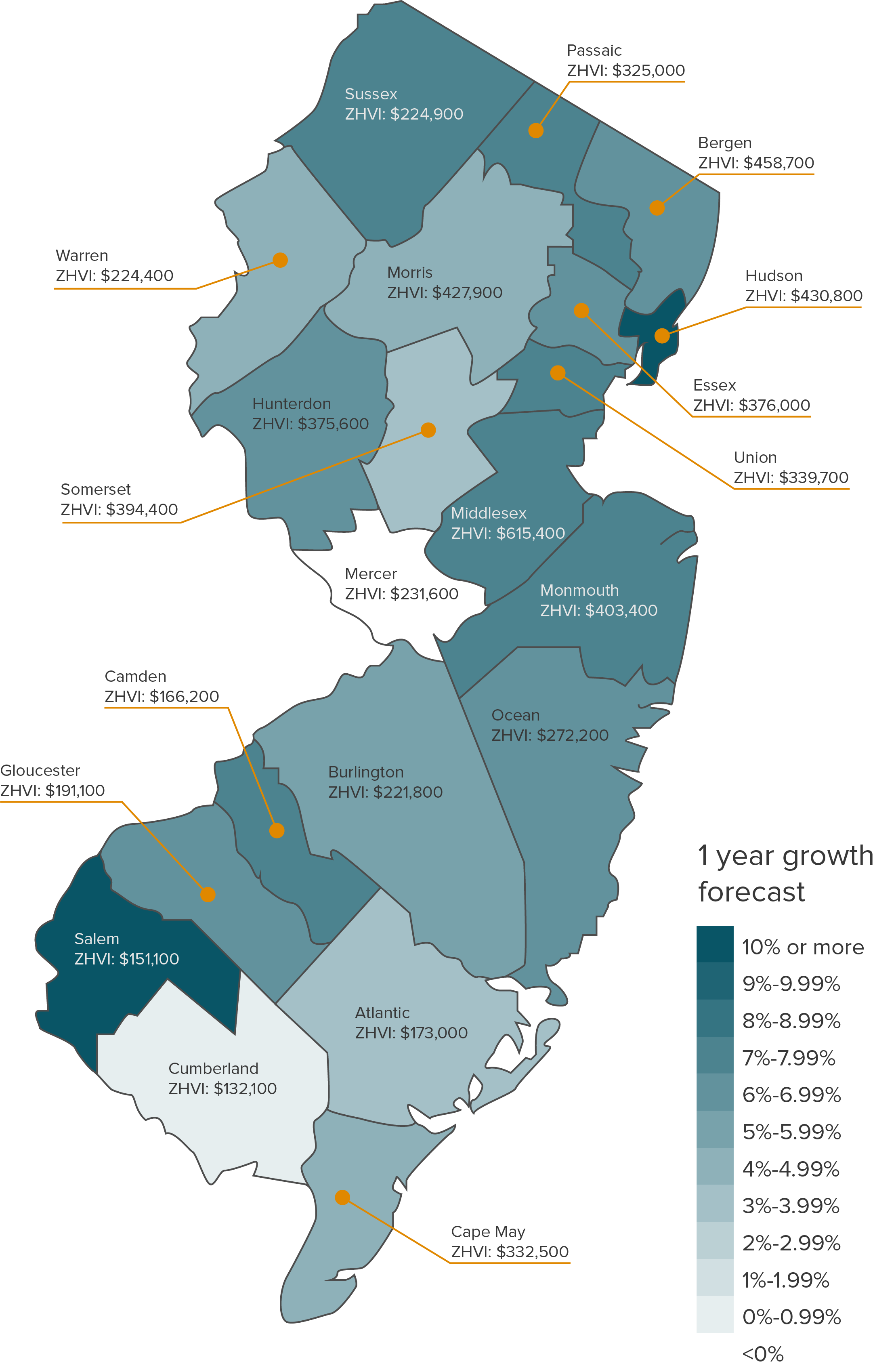

New Jersey Real Estate Snapshot

ABL Market Insights

The market sweet spot for single family homes is between $150k and $350k; there is high demand for houses in that range while the days on market for luxury houses over $1 million are increasing. Supply is still high, but profit margins are down because there are so many real estate investors bidding up house prices. Smart investors can still find homes on the MLS, but are checking online auction sites and researching estate sales for the best deals.

[su_table responsive=”yes”]

| Zillow | RealtyTrac | April 2018 Snapshot | |

| Median List Price | $309,900 | $299,000 | — |

| Median Sale Price | $253,200 | $255,000 | $285,000 |

| ZHVI (estimated home value) | $313,100 | — | — |

| Growth Forecast | 7.6% | — | — |

| Avg. Days on Market | 131 | — | 67 |

| Delinquent on Mortgage | 3.2% | — | — |

| Foreclosure Rate | 0.13% (0.08% higher than national average) | — |

[/su_table]

Click graphs to enlarge. Data from New Jersey Realtors Monthly Indicators Report, Zillow, and Realtytrac

Most Profitable NJ Fix & Flip Cities

According to the Year-End 2017 U.S. Home Flipping Report, these are the eleven NJ cities with the greatest returns on fix and flip investments last year.

ABL Market Insights

In Essex county, prices have gone up significantly over the last few years. As a result, investors need to be cautious about the property purchase price. For example, the same house that investors could purchase for $60k plus rehab and sell for $225k-$250k five years ago is now going for $150k plus rehab with an ARV of $325k-$350k. While the gross profits are similar in both cases, the ROI today is lower than it used to be because the initial property investment is so much greater.

In urban areas, flippers are starting to shift to a rental strategy so that when the market corrects, they will have a stream of income.

1: Orange, Essex County (ROI: 289.7%)

Originally part of Newark, Orange was incorporated in 1806 and is now home to over 30,000 people. This township is one of four NJ cities and townships that make up “the Oranges.” As with many of the other cities on this list, Orange is a short drive from Manhattan – 26 minutes without traffic, making it popular with commuters to NYC.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: $194,800 | Crime Rating: D- | Zip Code(s) Included: 07050 |

| Very hot (Sellers’) market | School Rating: – | Avg. gross profit: $170,900 |

| 1-yr. growth forecast: 13.6% | Median Household Income: – | Median purchase: $59,000 |

| Median listing: $177,500 | Unemployment: – | Median sale: $229,900 |

| Median sale: – | Percent of Vacant Homes: – | Home flipping rate: 6.3% |

| Rent Index: $1,633 | Homes for Sale: – | Avg. Days to Flip: 187 |

2: Irvington, Essex County (ROI: 244.0%)

Named in honor of American writer Washington Irving, this fix and flip hotspot is the 8th most densely populated town in New Jersey and the 17th most densely populated city in America. It is just south of Orange and just as popular with commuters to the city.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: – | Crime Rating: C | Zip Code(s) Included: 07111 |

| Warm (Sellers’) Market | School Rating: – | Avg. gross profit: $109,800 |

| 1-yr. growth forecast: – | Median Household Income: – | Median purchase: $45,000 |

| Median listing: $119,450 | Unemployment: – | Median sale: $154,800 |

| Median sale: – | Percent of Vacant Homes: – | Home flipping rate: 7.8% |

| Rent Index: $1,500 | Homes for Sale: – | Avg. Days to Flip: 179 |

3: Sussex, Sussex County (ROI: 234.9%)

Sussex is a quaint town in North Jersey and the only Sussex County locale on this list. It boasts a highly rated modern art gallery, five churches, and proximity to the Wallkill River National Wildlife Refuge.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: – | Crime Rating: A+ | Zip Code(s) Included: 07461 |

| – | School Rating: B- | Avg. gross profit: $164,450 |

| 1-yr. growth forecast: – | Median Household Income: $40,978 | Median purchase: $70,000 |

| Median listing: – | Unemployment: 4.80% | Median sale: $234,450 |

| Median sale: – | Percent of Vacant Homes: 19.64% | Home flipping rate: 6.4% |

| Rent Index: $1,571 | Homes for Sale: 140 | Avg. Days to Flip: 223 |

4: Pennsville, Salem County (ROI: 230.5%)

Pennsville sits on the south-western corner of NJ. The southern portion of the township is occupied by the Supawna Meadows National Wildlife Center which provides visitors with the opportunity to hike, fish, and hunt.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: $141,400 | Crime Rating: C+ | Zip Code(s) Included: 08070 |

| Cold (Buyers’) Market | School Rating: B+ | Avg. gross profit: $101,025 |

| 1-yr. growth forecast: 9.9% | Median Household Income: $59,154 | Median purchase: $43,825 |

| Median listing: $113,450 | Unemployment: 6.70% | Median sale: $144,850 |

| Median sale: – | Percent of Vacant Homes: 4.57% | Home flipping rate: 7.6% |

| Rent Index: $1,221 | Homes for Sale: 156 | Avg. Days to Flip: 177 |

5: Highlands, Monmouth County (ROI: 220.0%)

From this coastal town, residents can get to Manhattan in one hour by car or two hours by ferry as well as enjoy a beautiful view of the NYC skyline. Additionally, the borough lays claim to several highly rated seafood restaurants and the historic Twin Lights.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: $267,300 | Crime Rating: A+ | Zip Code(s) Included: 07732 |

| Warm (Sellers’) Market | School Rating: B | Avg. gross profit: $165,000 |

| 1-yr. growth forecast: 11.2% | Median Household Income: $75,291 | Median purchase: $75,000 |

| Median listing: – | Unemployment: 4.3% | Median sale: $240,000 |

| Median sale: – | Percent of Vacant Homes: 19.91% | Home flipping rate: 8.7% |

| Rent Index: $2,099 | Homes for Sale: 19.91 | Avg. Days to Flip: 153 |

6: East Orange, Essex County (ROI: 249.0%)

The second and final of “the Oranges” on this list, East Orange is composed of five separate wards and is only a 22 minute drive from Manhattan. The city offers multiple diversions for commuters to enjoy on the weekends, containing five parks and an 18-hole golf course.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: – | Crime Rating: C+ | Zip Code(s) Included: 07018, 07017 |

| Warn (Sellers’) Market | School Rating: D+ | Avg. gross profit: $130,765 |

| 1-yr. growth forecast: – | Median Household Income: $40,358 | Median purchase: $60,730 |

| Median listing: $180,000 | Unemployment: 6.80% | Median sale: $191,500 |

| Median sale: – | Percent of Vacant Homes: 16.18% | Home flipping rate: 6.6% |

| Rent Index: $1,511 | Homes for Sale: 167 | Avg. Days to Flip: 180 |

7: Highland Lakes, Sussex County (ROI: 205.4%)

Although this community is technically unincorporated, it still made an impressive showing compared to many of NJ’s official cities and towns with a 2017 ROI of over 200%. The area is aptly named with more than six natural and manmade lakes in around six square miles. It is a popular summer location for city dwellers with a country club, nature trails, and log cabins.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: $169,300 | Crime Rating: – | Zip Code(s) Included: 07422 |

| Cool (Buyers’) market | School Rating: – | Avg. gross profit: $133,500 |

| 1-yr. growth forecast: 11.4% | Median Household Income: – | Median purchase: $65,000 |

| Median listing: 135,450 | Unemployment: – | Median sale: $198,500 |

| Median sale: – | Percent of Vacant Homes: – | Home flipping rate: 6.3% |

| Rent Index: $1,651 | Homes for Sale: 74 | Avg. Days to Flip: 245 |

8: Westville, Gloucester County (ROI: 202.0%)

The first Southern Jersey location on this list, Westville is located just across the Delaware River from Philadelphia. This family-friendly town has a bustling small business scene with a pub, spa, bakery, and several other local shops and businesses.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: $126,300 | Crime Rating: A- | Zip Code(s) Included: 08093 |

| – | School Rating: C+ | Avg. gross profit: $94,975 |

| 1-yr. growth forecast: 5.2% | Median Household Income: $49,854 | Median purchase: $47,025 |

| Median listing: – | Unemployment: 4.90% | Median sale: $142,000 |

| Median sale: – | Percent of Vacant Homes: 2.50% | Home flipping rate:12.8% |

| Rent Index: $1,466 | Homes for Sale: 35 | Avg. Days to Flip: 167 |

9: Gloucester City, Camden County (ROI: 201.7%)

Just north of Westville, Gloucester City is also popular with Philly commuters. Some consider this city the birthplace of rock and roll because Bill Haley & His Comets spent 18 months developing their musical style at a Gloucester bar.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: $84,600 | Crime Rating: B | Zip Code(s) Included: 08030 |

| Very cold (Buyers’) market | School Rating: C- | Avg. gross profit: $63,675 |

| 1-yr. growth forecast: – | Median Household Income: $52,222 | Median purchase: $31,575 |

| Median listing: $70,000 | Unemployment: 5.20% | Median sale: $95,250 |

| Median sale: – | Percent of Vacant Homes: 9.42% | Home flipping rate: 9.7% |

| Rent Index: $1,305 | Homes for Sale: 67 | Avg. Days to Flip: 219 |

10: Pleasantville, Atlantic County (ROI: 200.0%)

The third and final southern Jersey city to make the list – and the only one not in the Philadelphia metro area. Pleasantville has plenty to offer residents, including a yacht club, little league, and proximity to Atlantic City.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: $84,600 | Crime Rating: B | Zip Code(s) Included: 08232 |

| Very cold (Buyers’) market | School Rating: C- | Avg. gross profit: $63,675 |

| 1-yr. growth forecast: – | Median Household Income: $52,222 | Median purchase: $31,575 |

| Median listing: $70,000 | Unemployment: 5.20% | Median sale: $95,250 |

| Median sale: – | Percent of Vacant Homes: 9.42% | Home flipping rate: 9.7% |

| Rent Index: $1,305 | Homes for Sale: 67 | Avg. Days to Flip: 219 |

11: Newark, Essex County (ROI: 192.4%)

Not only is Newark the largest city in New Jersey, but it is one of the locations with the greatest profit potential for fix and flip investors. The city was listed as one of the twenty finalists for Amazon’s second headquarters in April, and potential homebuyers see the city’s proximity to Manhattan as a huge perk, too.

| Zillow | RealtyTrac | ATTOM Flipping Report |

| ZHVI: $225,700 | Crime Rating: D- | Zip Code(s) Included: 07106, 07108, 07103, 07112, 07104, 07107 |

| Hot (Sellers’) market | School Rating: D | Avg. gross profit: $149,350 |

| 1-yr. growth forecast: – | Median Household Income: $35,659 | Median purchase: $95,235 |

| Median listing: $216,273 | Unemployment: 7.80% | Median sale: $244,585 |

| Median sale: – | Percent of Vacant Homes: 15.58% | Home flipping rate: 7.6% |

| Rent Index: $1,503 | Homes for Sale: 280 | Avg. Days to Flip: 189 |

[su_divider top=”no” divider_color=”#e4e4e4″ size=”1″ margin=”5″]

If you’re looking to invest in real estate in New Jersey, Asset Based Lending is the leading local hard money lender with the expertise, funds, and commitment to help you succeed. Get in touch to discuss your deal or fill out our online prequalification form to learn what ABL can do for you.

- https://www.wsj.com/articles/why-new-jerseys-soaring-foreclosures-are-good-for-the-housing-market-1520082000

- https://therealdeal.com/2018/03/04/why-jerseys-foreclosure-crisis-is-cause-for-celebration-to-some/

- https://www.app.com/story/opinion/columnists/2018/01/26/nj-real-estate-residential-trends-peter-reinhart/109841934/

- https://re-nj.com/real-estate-njs-2018-market-forecast/

- https://www.nj.com/politics/index.ssf/2018/06/phil_murphy_slams_fellow_democrats_budget_counterp.html

- https://www.niche.com/places-to-live/search/best-places-to-buy-a-house/s/new-jersey/

- https://www.realtytrac.com/statsandtrends/nj/?address=New%20Jersey%2C%20NJ%20&parsed=1&ct=new%20jersey&stc=nj&lat=40.1387786865234&lon=-74.6769104003906

- https://www.zillow.com/nj/home-values/

- https://www.realtytrac.com/statsandtrends/nj/?address=New%20Jersey%2C%20NJ%20&parsed=1&ct=new%20jersey&stc=nj&lat=40.1387786865234&lon=-74.6769104003906

- https://njar-public.stats.10kresearch.com/docs/mmi/x/report?src=page

- https://www.attomdata.com/news/home-flipping/2017-u-s-home-flipping-report/