With competitive deal terms and the ability to finance projects across the country, national lenders may seem like a viable lending option for some hard money borrowers.

However, it is important to understand how many national lenders differ from their regional alternatives. To national lenders, your loan is simply a set of numbers. If your purchase, rehab, and ARV projections match an acceptable risk matrix, your project will be approved— but that does not necessarily mean it is a good deal.

A local lender will take the time to ensure that you have the resources you need to outfit and update your investment property with all the most desirable improvements—but only after seriously and honestly assessing your deal’s potential. Local lenders know your neighborhood, prioritize your project, and are often personally (and financially) invested in your success.

They Can Be Flexible

Local lenders listen to your story. Because they put their own funds toward your project, their underwriting criteria is inherently flexible based on the unique scenario. Local direct lenders take the time to understand your situation and turn the underwriting process into a more personal experience.

With national lenders, there are no exceptions. Most national lenders package and sell their loans to private equity firms, transferring risk to the buyer. Based on what the firms are willing to purchase, lenders create boxes for acceptable deals based entirely on numbers and statistics. If you fit in the box, you get a loan. If your credit score is just a few points too low, these lenders may reject your loan—no matter how experienced you are or how high your ARV is.

When lenders keep their loans, they can evaluate the true quality and potential of a deal, without worrying about how the stats look to an outsider. With local direct lenders, you will find more underwriting flexibility and the approval process will be a conversation rather than a series of checkboxes.

They Want You to Succeed

While portfolio lenders are personally invested in your success, national lenders may not be as concerned with the final success or failure of your project, since they have likely sold the mortgage and transferred the risk.

To break it down, a national lender may offer you a $300,000 loan with a 12% interest rate and a 2-point program for your project. Once the deal is closed, the lender will sell your loan, including all risk, and the bulk of your interest payments to a private equity firm, while keeping the $6,000 origination fee. The lender sends a portion of your monthly payments to the buyer and keeps the remaining interest. This process continues as long as you uphold your monthly payments.

However, if the loan falls through, the lender has nothing to lose—it is no longer their principal at risk. This transaction results in a lack of personal investment in you and your project.

They Provide More Individualized Support

To local lenders, you matter—not just because their own money is invested in you and your project. Most times, they get together in person or on the phone with their individual borrowers to answer questions, allay doubts, give valuable tips, and provide other information. They want to fulfill your needs while avoiding any unnecessarily stressful situations.

Unlike national lenders who try to keep personal interactions to a minimum, local lenders always prefer to talk with their clients over the phone or meet up with them in person. Even if interactions are not always face-to-face, local lenders remain by your side throughout the entire loan process. The individualized support that local lenders provide not only encourages success but also helps to maximize the return on investment for your project.

They Live Where They Lend

Since local lenders only concentrate on—and often physically work in— the few areas they lend within, they do not just know the market but live the market. What sells? When should you sell? What do buyers want? What will they want in six months? These are all questions that an experienced local lender can answer in great depth.

For years, they have watched markets fluctuate and have been a part of many different types of projects—giving them an intimate understanding of the past, present, and future of local real estate investing. They can often detect and correct investment mistakes before they happen—saving you time and money.

National lenders must spread their efforts across a multitude of states and markets, unable to concentrate on one specific area. The secret to successful real estate investing is understanding the markets within the markets—it is a “block-by-block” game, not a state-by-state one.

For example, if you are investing in a property in Newark, NJ, one block north or south could make or break your project. Local lenders have learned that property values differ immensely within these micro-markets. In the long run, this detailed knowledge on what is desirable in an area will help to increase the return on investment for your project.

They Save You Time

With local lenders, you are one phone call away from the decision-makers who have control over the funds. They can move quickly and efficiently because they do not need to wait for the greenlight from backers to approve loans or fulfill draw requests. No extra approvals means one less step in the process, keeping your project on time and on budget.

Because of where they are situated, local lenders can often quickly visit and inspect properties if needed. Usually, they will send a local appraiser to the property instead—but unlike the Appraisal Management Companies (AMCs) that national lenders use, local appraisers are in close contact with your local lender, receive background information on your project before their visit, and can quickly be onsite to inspect the property.

They Know All the Right People

When it comes to contractors, inspectors, and other service providers, quality is everything and it is hard to know who to trust. Fortunately, local lenders have often worked with dozens of experienced service providers during the years and have gotten a good grasp on the kind of work they do—and if they do it well.

Through the years, local lenders have accumulated an entire network of trustworthy service providers in the area that they can put you in contact with. As an investor, you can also benefit from local lender’s connections with past investors—who can give referrals based on firsthand experiences. Because of this network of local service providers that local lenders continue to build upon, you have a wide range of reliable options to choose from.

Here at ABL

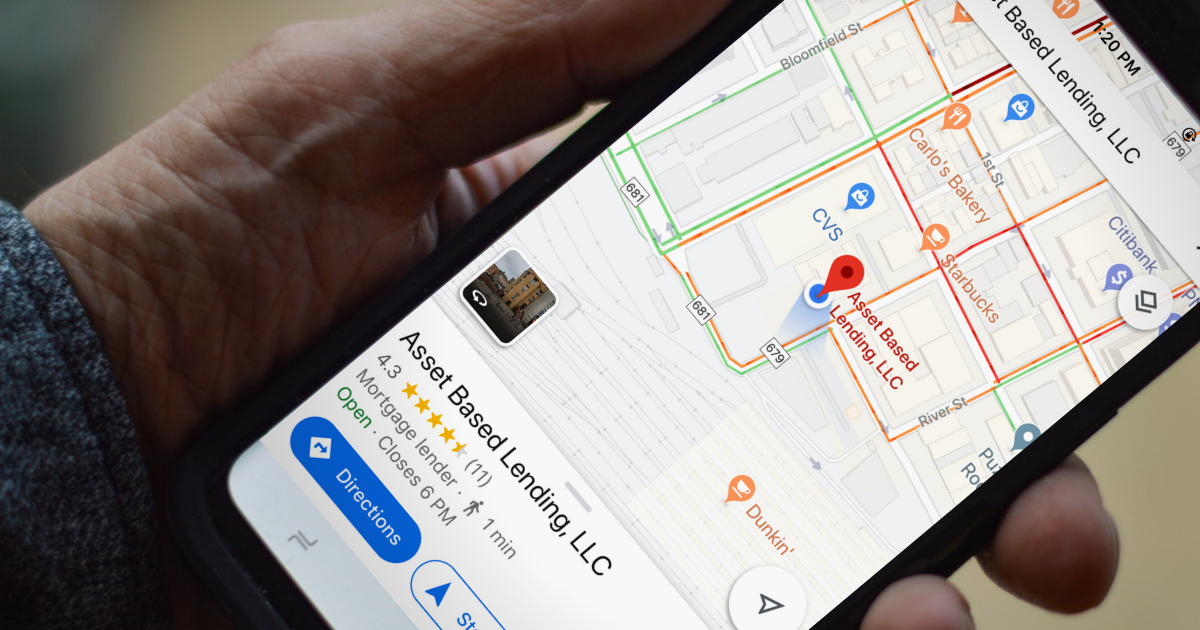

If you are looking for an experienced local lender to fund your next real estate investment, Asset Based Lending specializes in regional hard money lending. We offer loans in New Jersey, New York, Florida, Maryland, Pennsylvania, Virginia, Washington DC, and Delaware.

Contact ABL at 201-942-9090 and ask to speak with your local loan officer or pre-qualify online.

Pre-Qualify Today