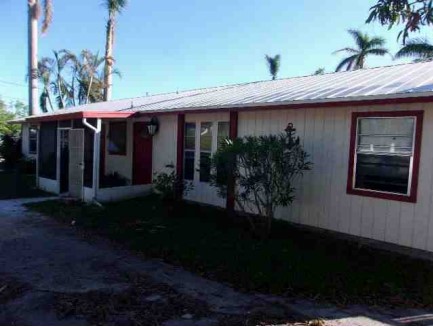

Asset Based Lending recently funded a hard money fix and flip loan in North Fort Myers. The borrower is a repeat borrower and full time real estate investor. The property is a two-unit multifamily with one unit being 3-bedroom, 2-bathroom measured at 1,100 square feet and the other unit being 2-bedroom, 1-bathroom measured at 750 square feet. Property received some damage through flooding and wind impact during Hurricane Ian, so borrower will be repairing and renovating before flipping. Exterior will have repairs to the wood siding, new doors, new fence, and new windows if repairs cannot be made. Interior will receive fresh paint, LVP floors, and potentially new HVAC if repairs are not sufficient. Kitchen will receive new cabinets, granite counters, tile backsplash, and mid-level stainless steel appliances. Bathrooms will be gutted and receive new toilets, vanities, tubs, and wall tiles. Project is expected to take upwards of six months with final sale occurring shortly after completion.