Connecticut Hard Money Loans for Real Estate Investors

Fix & Flip

Loans

It takes vision to spot distressed properties with potential, and capital to transform them into profitable sales. Our fix and flip loans are essential to your success, offering financing for both experienced investors and qualified newcomers. With closing possible in 3-4 days and averaging just 10 days, our hard money loans provide speed traditional lenders can’t match. Financing covers up to 85% of purchase price and 100% of repair costs, giving you the resources to maximize returns.

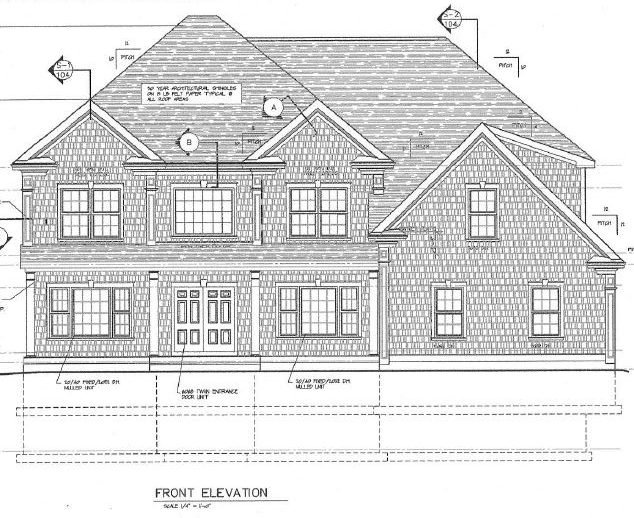

New Construction

Loans

We at ABL offer fast, flexible underwriting for new construction projects, adapting to seasonal and market conditions when conventional financing isn’t viable. Our innovative CT construction loans serve experienced investors, contractors and builders, covering up to 70% of land value plus 100% of construction costs. With flexible requirements and no minimum credit score, we maintain rigorous profitability standards that protect all parties, ensuring only viable projects receive funding.

Rental

Loans

Asset Based Lending provides private rental loans for Connecticut buy and hold investors, offering doc-light financing for 1-4 family properties with single loans and portfolios up to $3M each. With rates from 6% and up to 80% LTV, our flexible options include 30-year amortization, ARM, and interest-only terms. We evaluate deals based on property income potential rather than borrower financials, working with investors at all experience levels. Our partnerships with top local professionals ensure a five-star experience throughout the loan process.

Home of the Only True Zero-Point Program

- No Pre-Pay Penalty

- No Exit Fees

- Available for All Experience Levels