Florida Hard Money Loans for Real Estate Investors

Fix & Flip

Loans

We specialize in fix and flip loans in Florida, providing fast and reliable access to capital for investors who can spot potential in problem properties in a state with increasing home values, growing population, and decreasing time on market. We can close loans in as few as three days (10 days on average), offering financing that covers up to 85% of purchase price and 100% of rehab costs – giving our investors a distinct advantage in hot markets where typical lenders cannot move quickly enough. We have close relationships with borrowers investing in Florida’s top fix and flip cities and have assembled a comprehensive guide for both new and experienced investors to ensure they take the right path forward in the sunshine state.

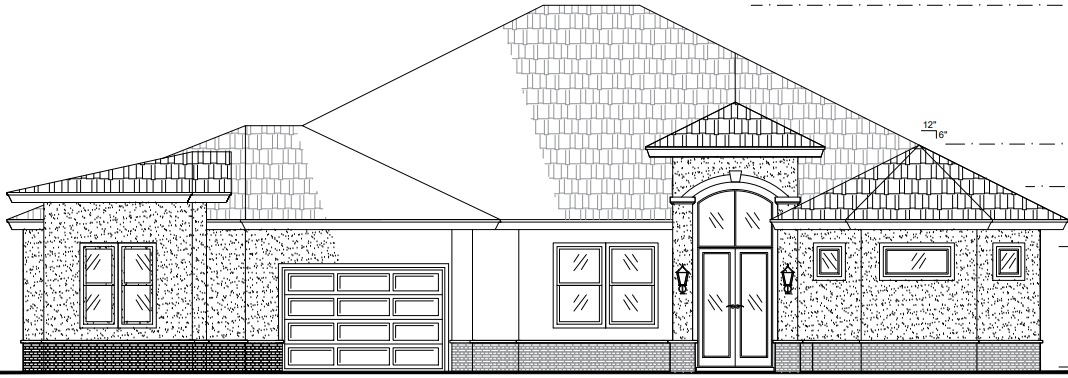

New Construction

Loans

We are extremely active in funding Florida new construction projects with hard money loans when conventional financing isn’t the right answer, providing experienced investors, contractors, and builders with funding for 70% of land value and 100% of construction costs. Our flexible underwriting criteria allows us to accommodate various project types, though we carefully assess each borrower’s experience level. We only fund loans when we’re confident that everyone involved in the deal will profit from the venture.

Rental

Loans

We proudly offer term rental loans for Florida real estate investors looking to begin or expand their rental portfolios, with financing for 1-4 family properties and flexible options including 30-year amortizing, ARM, or interest-only terms. Our team works with investors of all experience levels, assessing each deal based on income-producing viability for those following the BRRRR strategy (buy, rehab, rent, refinance, repeat). Our unique capital structure enables us to offer highly competitive loans with rates starting at 6% and up to 80% LTV, allowing you to grow your portfolio faster and generate passive monthly income sooner.

Home of the Only True Zero-Point Program

- No Pre-Pay Penalty

- No Exit Fees

- Available for All Experience Levels