Louisiana Hard Money Loans for Real Estate Investors

Fix & Flip

Loans

We meet investors with the urgency required to land deals quickly, offering flexible underwriting that enables taking on more projects than traditional financing allows, with closings averaging 10 days or less. Our 12-month bridge loans allow Louisiana fix and flip investors to launch projects with the most competitive rates on the market, including our industry’s only true zero-point program, covering up to 85% of purchase price and 100% of rehab costs. Whether you’re new to investing or a seasoned fix and flip professional, we have loan options tailored to help you scale your business efficiently.

- Loan Term: 12-24 months

- LTV: 92.5% of purchase, 100% of rehab

- Loan Size: $75K - $50M

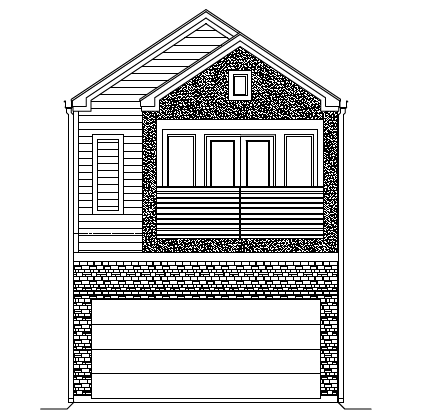

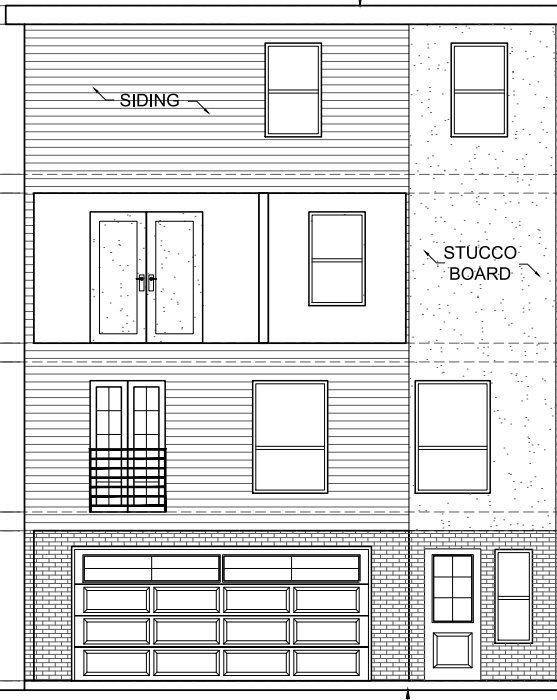

New Construction

Loans

We offer 12-month, interest-only new construction loans with competitive interest rates, fast draw turnarounds, and flexible underwriting for Louisiana real estate investors, allowing borrowing up to 70% of land value and 100% of construction costs. Our ground-up construction loans are tailored to fit borrowers’ needs and structured to ensure they receive the best terms for their preferred investment strategy. We carefully assess each deal’s unique qualifications and evaluate investor experience levels to ensure all parties benefit from every project we fund.

- Loan Term: 12 - 24 months

- LTV: Up to 75% for land, 100% for construction budget

- Loan Size: $75K - $50M

Rental

Loans

We offer simple, reliable DSCR rental loans for Louisiana investors pursuing buy-and-hold strategies, with options for properties between 1-8 units or entire portfolio refinancing. Our flexible rental loan options include 30-year amortization, ARM, and interest-only terms with competitive rates starting at 6% and leverage up to 80% LTV for single rental loans and portfolios up to $3M each. We serve as a one-stop shop for Louisiana real estate investors, allowing those who used our bridge loans for construction or Fix & Flip projects to refinance directly into our DSCR program for long-term holds.

- Loan Term: 30 years

- LTV: Up to 80%

- Average DSCR: 1.0

- Loan Size: $85K – $2M

Home of the Only True Zero-Point Program

- No Pre-Pay Penalty

- No Exit Fees

- Available for All Experience Levels