New York Hard Money Loans for Real Estate Investors

Fix & Flip

Loans

Experienced real estate investors across New York rely on Asset Based Lending for premium Fix & Flip loans with industry-leading rates and flexible terms. Our streamlined approval process provides funding in as little as 24 hours, with loans from $100,000 to $3.5 million covering up to 90% of project costs. ABL’s New York Fix & Flip loans deliver the financial backing needed to transform undervalued properties into profitable investments across the Empire State’s competitive markets.

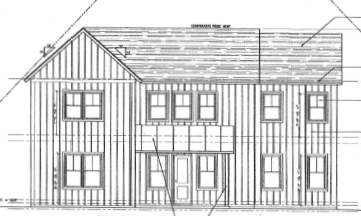

New Construction

Loans

From foundation to completion, Asset Based Lending’s New Construction Loans in New York offer rapid funding solutions for developers in prime areas from NYC to growing upstate communities. With competitive rates, loan-to-cost ratios up to 90%, and flexible draw schedules, our financing supports builders through each phase in New York’s complex regulatory environment. ABL’s streamlined process provides loans from $100,000 to $3.5 million, giving developers the resources to succeed in one of the nation’s most valuable markets.

Rental

Loans

Maximize your investment potential with Asset Based Lending’s specialized DSCR Rental Loans in New York, based solely on property cash flow rather than personal income. With competitive rates, loans up to $3.5 million, and flexible terms, our program is designed for investors targeting high-demand areas from Manhattan to Rochester and the Hudson Valley. No tax returns required, interest-only options available, and closings as quick as 10 days give investors the leverage needed to build wealth through New York’s resilient rental market.

Home of the Only True Zero-Point Program

- No Pre-Pay Penalty

- No Exit Fees

- Available for All Experience Levels