Texas Hard Money Loans for Real Estate Investors

Fix & Flip

Loans

We partner with Texas real estate investors looking to transform distressed properties into gorgeous homes, offering hard money fix and flip loans that fund up to 90% of purchase price and 100% of rehab costs with closings in as little as 10 days and approvals in just 24 hours. Our 12-month bridge loans feature flexible underwriting options including lower interest rates, maximum leverage, or zero points, with our team of experts understanding the unique requirements of different markets from Dallas to San Antonio. Whether you’re flipping your first property or you’re a full-time investor, we’re ready to finance your next success with our local market expertise and transparent loan process that eliminates hidden fees and provides direct access to decision makers.

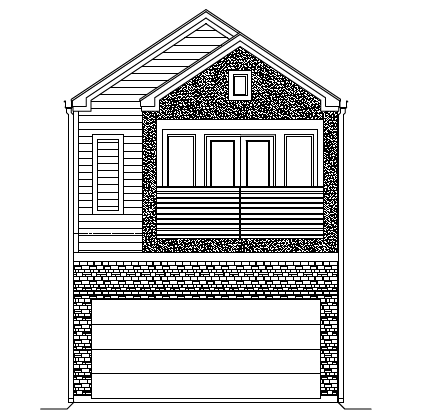

New Construction

Loans

With Texas housing inventory at record lows and demand for residential new construction peaking, we provide hard money loans with competitive interest rates, flexible underwriting, and fast draw turnarounds for experienced investors, builders, and contractors. Our new construction loans allow borrowing up to 90% of land value and 100% of construction costs, giving you the capital needed to capitalize on today’s market opportunities. We tailor each construction loan to match your specific project needs while assessing investor experience and build viability, ensuring the deal remains profitable for all parties with loan flexibility unmatched by other Texas hard money lenders.

Rental

Loans

We offer the most reliable and straightforward rental loans for BRRRR investors in Texas, with rates starting as low as 4%, leverage up to 80% LTV, and flexible options including 30-year amortization, ARM, and interest-only plans for 1-4 family properties. Our unique capital structure allows us to provide single rental loans up to $3M and portfolio loans up to $6.25M for investors at all experience levels, with each deal assessed based on the property’s income-producing potential. As experts in Texas’s local real estate markets, we’re committed to delivering a five-star experience throughout the loan process, creating customized funding solutions that support your long-term investment strategy.

Home of the Only True Zero-Point Program

- No Pre-Pay Penalty

- No Exit Fees

- Available for All Experience Levels