West Virginia Hard Money Loans for Real Estate Investors

Fix & Flip

Loans

We provide fast, flexible 12-month bridge loans for fix and flip investors throughout West Virginia, including major counties like Kanawha, Berkeley, and Monongalia. Our West Virginia fix and flip loans are designed for investors looking to purchase distressed properties, renovate them, and sell for profit with quick approvals and closings. We tailor each loan to match your specific project needs, whether you’re a first-time flipper or an experienced investor looking to expand your portfolio in the Mountain State.

- Loan Term: 12-24 months

- LTV: 92.5% of purchase, 100% of rehab

- Loan Size: $75K - $50M

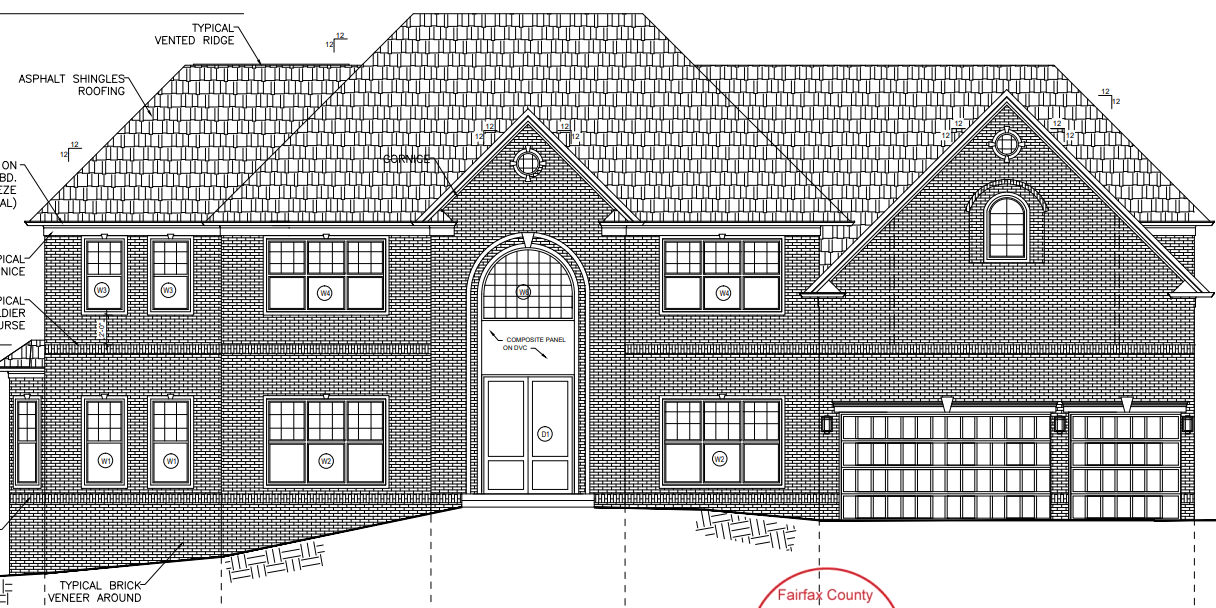

New Construction

Loans

We at ABL offer competitive 12-month bridge loans for new construction projects across West Virginia, helping investors address the growing demand for housing in this evolving market. Our flexible underwriting process allows us to customize construction loans that match your specific project requirements with funding available for land acquisition and building costs. As West Virginia’s premier hard money lender, we provide the fast funding you need to capitalize on new construction opportunities with loan terms designed for your success.

- Loan Term: 12 - 24 months

- LTV: Up to 75% for land, 100% for construction budget

- Loan Size: $75K - $50M

Rental

Loans

We offer DSCR rental loans for long-term real estate investors throughout West Virginia who are looking to build or expand their rental property portfolios. Our competitive rental loan programs feature flexible terms tailored to your investment strategy, whether you’re purchasing your first rental property or refinancing existing holdings. With our commitment to five-star service and deep understanding of West Virginia’s rental markets, we’re the ideal lending partner for investors focused on building long-term wealth through rental properties.

- Loan Term: 30 years

- LTV: Up to 80%

- Average DSCR: 1.0

- Loan Size: $85K – $2M

Home of the Only True Zero-Point Program

- No Pre-Pay Penalty

- No Exit Fees

- Available for All Experience Levels