Our Hard Money Loan Programs

Fix & Flip

Buy and rehab residential. Close in as few as 10 days.

- Loan Term: 12-24 months

- LTV: 90% of purchase, 100% of rehab

- Loan Size: $75K - $50M

- Loan Term: 12-24 months

- LTV: 90% of purchase, 100% of rehab

- Loan Size: $75K - $50M

Rental Loans

Take out or refinance into a 30-year rental loan - whether you want to buy or unlock equity for your next investment project.

- Loan Term: 30 years

- LTV: Up to 80%

- Average DSCR: 1.1

- Loan Size: $75K – $5M

- Loan Term: 30 years

- LTV: Up to 80%

- Average DSCR: 1.1

- Loan Size: $75K – $5M

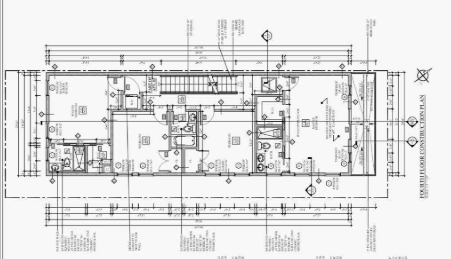

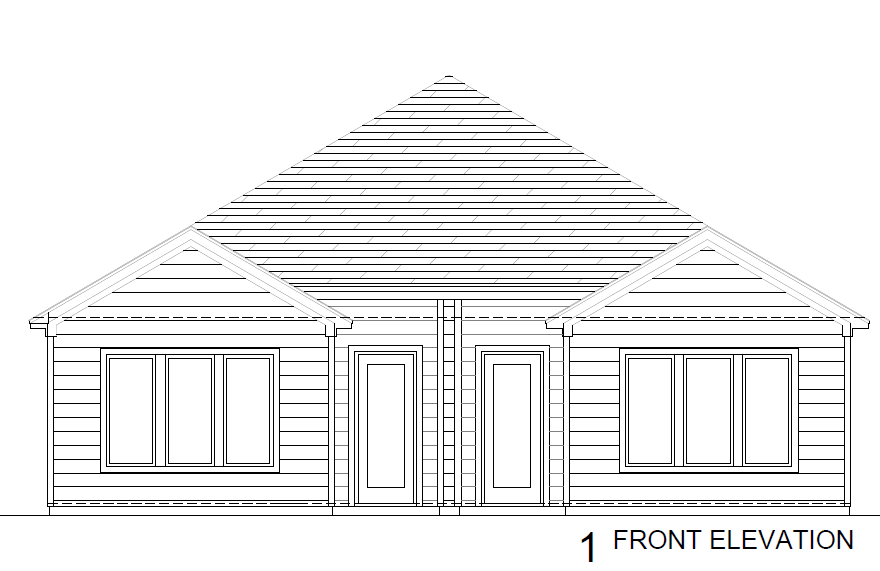

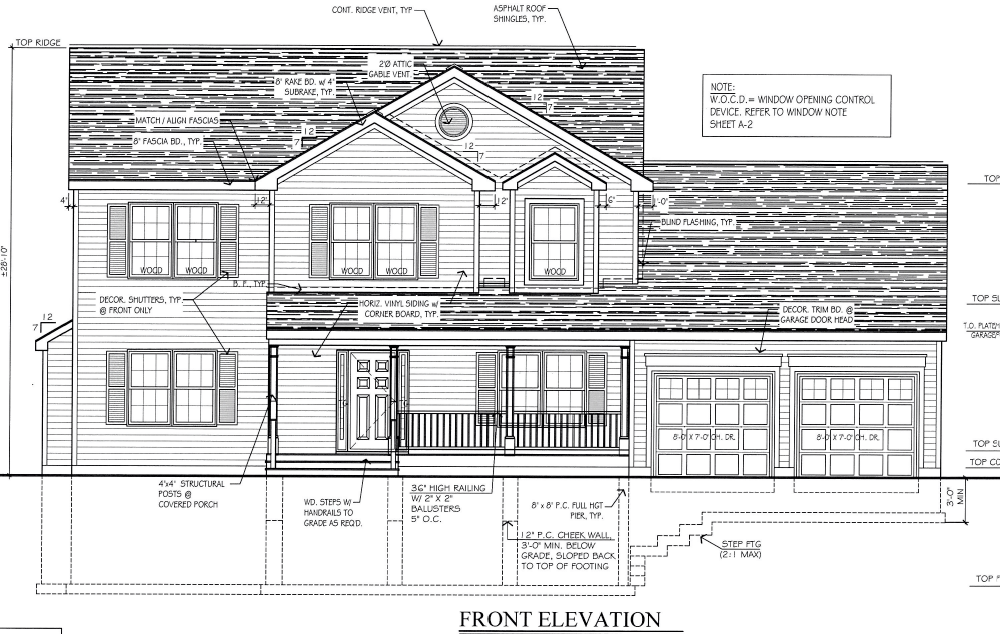

New Construction

Acquire or refinance land to build a new property - new investors welcome.

- Loan Term: 12 - 24 months

- LTV: Up to 70% for land, 100% for construction budget

- Loan Size: $75K - $50M

- Loan Term: 12 - 24 months

- LTV: Up to 70% for land, 100% for construction budget

- Loan Size: $75K - $50M

Bridge

Refinance and extract equity from a single-family, multi-family, and condo. Use the cash for whatever you want.

- Loan Term: 12-24 months

- LTV: Up to 65%

- Loan Size: $75K - $50M

- Loan Term: 12-24 months

- LTV: Up to 65%

- Loan Size: $75K - $50M

Get quick funding for your next real estate investment—whether it’s a fix & flip, new construction, or long-term rental. We help beginner and experienced investors grow their property portfolios faster.

How It Works

Initial Contact

Contact us with basic info on your proposed investment. We’ll let you know whether ABL is a good fit within 24 hours.

Underwriting

Fill out a loan application with further details. We’ll schedule an appraisal and approve the loan if it meets our criteria.

Closing

Sign closing documents and start collecting loan funds in installments or as a lump sum (depending on loan type).