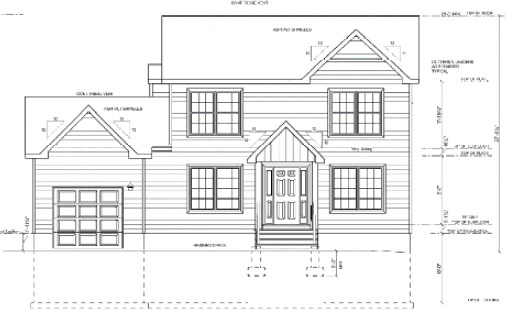

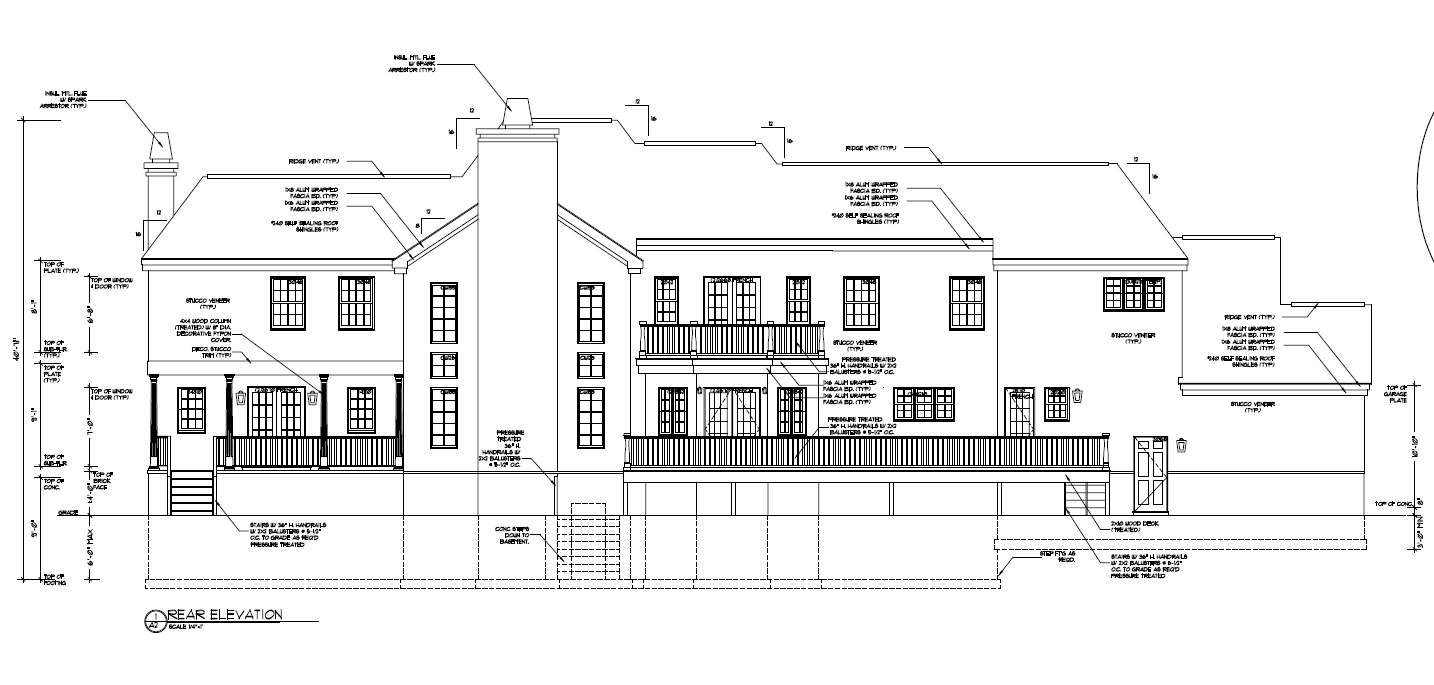

New Construction

Loans From The

Ground Up.

Whether you're a seasoned builder, a veteran investor, or a general contractor ready to start your own investment projects, Asset Based Lending's new construction loans keep your project moving from lot purchase to final walkthrough. We'll close your loan in as few as 20 days you can break ground sooner and stay on schedule.